The $50,000 Romance Scam: How Fake Profiles Target Grieving Widows

A widow in her sixties lost $50,000 to a fake Army captain. Grief impairs our thinking. Scammers hunt social media for recently widowed profiles, targeting those 50+. They build trust in weeks. Love declarations follow. Then money requests come—medical emergencies, travel costs. We’re vulnerable when lonely. Over 800,000 Americans fall victim annually. Document conversations. Video chat. Reverse-search photos. Ask specific questions. Trust your instincts. Report suspicious profiles immediately. Financial institutions can help too. Building real relationships takes time, not days. Continue exploring what patterns reveal the full scope of these elaborate deceptions.

What You Should Know

- Scammers systematically target grieving widows on social media by scanning memorial posts and exploiting emotional vulnerability during the grief process.

- Romance scams yield over $2.4 billion annually, with older adults aged 50-75 being the primary targets, as evidenced by the $50,000 widow case.

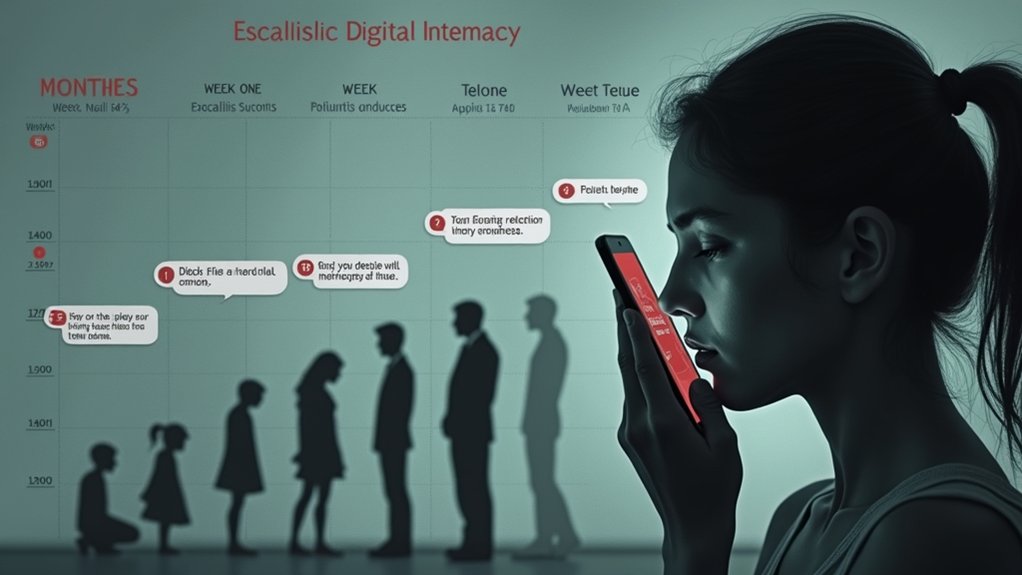

- Scammers employ a grooming timeline: building trust in week one, escalating emotional investment in weeks two-three, then requesting money under false pretenses.

- Red flags include rapid love declarations, reluctance for video chats, vague job explanations, and probing about finances disguised as casual conversation.

- Verification steps such as video chats, reverse image searches, detailed questioning, and family consultation can prevent substantial financial losses before money transfers occur.

How a Widow Lost $50,000 in Nine Months to a Fake Military Romance

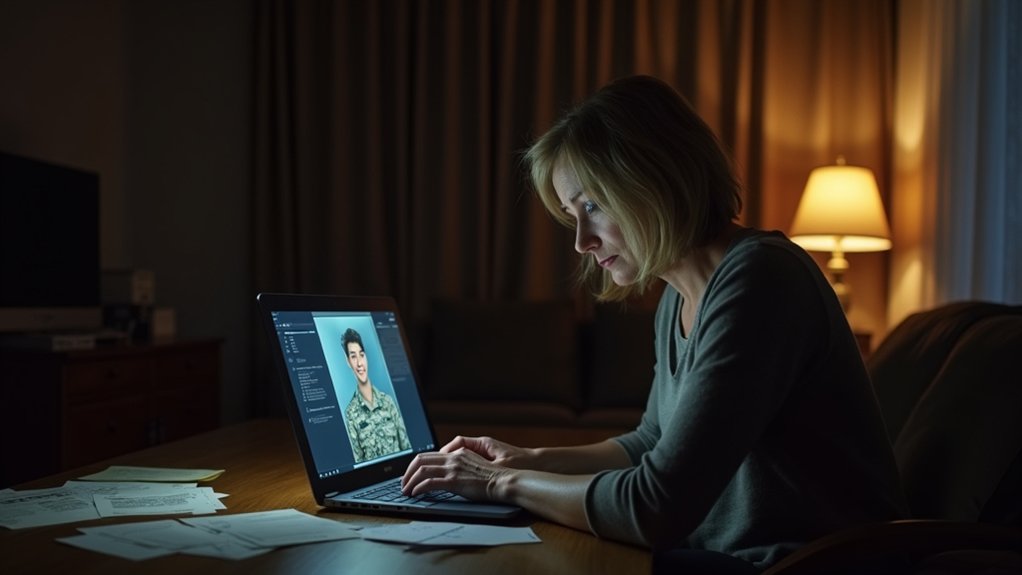

A widow’s nine-month spiral into financial devastation began with a Facebook friend request. She was traversing early grief stages when a charming “Army captain” messaged her daily.

Within weeks, he declared his love. She felt emotionally resilient enough to trust again—a dangerous miscalculation.

By month three, crisis struck. He needed money for a “medical emergency.” Then another. Then visa fees. She sent $50,000 across nine months through wire transfers and gift cards.

The pattern’s predictable. Scammers target recent widows relentlessly. They exploit loneliness. They weaponize sympathy. They request untraceable payments. Romance scams cost victims over $2.4 billion annually, with older adults aged 50-75 bearing the heaviest burden.

Here’s what we must do: verify identities through video calls, never wire money to strangers, report suspicious profiles immediately to the FBI’s IC3 website, and talk to trusted family before any major financial decision.

Grief makes us vulnerable. Awareness keeps us safe.

Why Grief Makes Widows Vulnerable to Emotional Manipulation

When grief hits hard, our brains don’t work the way they normally do. We’re searching for connection. We’re vulnerable. Scammers know this.

| Grief Stage | What Happens | Scammer’s Move |

|---|---|---|

| Shock (Weeks 1-4) | Numbness, isolation | Love-bombing begins |

| Denial (Months 1-3) | Longing for companionship | Mirroring and false empathy |

| Despair (Months 3-9) | Deepened loneliness | Escalated money requests |

| Adjustment (Year 1+) | Ongoing vulnerability | Repeated exploitation |

During grief cycles, our emotional resilience drops. We accept fast intimacy. We ignore red flags. A scammer texts daily. They say “I understand your pain.” They claim they’re widowed too. We believe them because we’re desperate for someone who gets it. Within nine months, we’ve sent $50,000. Our critical thinking has vanished. Our defenses are down. This isn’t weakness—it’s neuroscience. Research shows that psychological exploitation during vulnerable moments compounds financial and emotional devastation. Report immediately to your bank and the FTC.

Where Scammers Hunt for Recently Widowed Targets Online

Scammers know exactly where to find vulnerable widows: they’re scanning Facebook memorial posts and grief comments looking for fresh losses, then sliding into inboxes with fake friend requests.

Dating apps built for older adults like Match and eHarmony become hunting grounds because profiles stamped “recently widowed” or age 50+ signal loneliness, isolation, and access to life savings.

We’ve got to recognize that these platforms aren’t the problem—the predators weaponizing them are—and that’s why you need to lock down your grief signals now before someone exploits them.

Individuals aged 50-75 are particularly targeted by scammers who understand that chronic loneliness heightens susceptibility to emotional manipulation during vulnerable periods of grief.

Social Media Grief Signals

Because your Facebook profile tells your story—including your heartbreak—con artists actively scan social media looking for fresh grief.

They’re hunting. Right now. Here’s what makes you visible:

- Memorial posts within weeks of loss signal vulnerability and available time online

- “Recently widowed” status updates act like neon signs advertising loneliness and emotional need

- Grief expressions in comments sections reveal isolation and desire for connection

- Profile photos showing solo poses without your late spouse trigger targeting algorithms

Social media dynamics work against you.

Scammers monitor these grief signals constantly, building lists of potential victims.

Within months of your loss, they initiate contact through friend requests.

They mirror your pain. They offer understanding you desperately want.

But it’s calculated. Your vulnerability isn’t accidental—it’s their business model.

Scams exploit trust, authority, and fear, not intelligence, making grieving individuals especially susceptible to emotional manipulation during their most fragile moments.

Tighten privacy settings now. Limit who sees your loss narratives.

Dating Apps For Seniors

If you’re looking for companionship online after losing your spouse, dating apps designed for older adults feel like safe spaces—but they’ve become hunting grounds.

Match, eHarmony, and niche sites like DivorcedPeopleMeet attract millions of seniors seeking connection. Scammers scan these profiles deliberately. They spot “recently widowed” markers. They note your age. They calculate your vulnerability.

Here’s what happens: Within weeks, a charming stranger appears. Daily messages flood in. Declarations of love follow fast.

By week three, money requests emerge. One Pennsylvania widow lost $40,000 this way. A Cary woman lost her home. Scammers exploit emotional manipulation and urgency to pressure seniors into quick financial decisions without verification.

We need you vigilant. Verify profiles thoroughly. Meet in public first. Never send money to online-only contacts.

Report suspicious accounts immediately to platform support and local law enforcement. Online safety isn’t guaranteed—it’s earned through skepticism.

The Three-Month Grooming Timeline: From First Message to Financial Request

We need to understand how scammers transform a single message into financial exploitation within just weeks.

Week one brings charming texts, daily contact, and carefully crafted sympathy that mirrors your grief back to you like a mirror reflecting exactly what you’re desperate to hear.

Week One: Building Initial Trust

During the first seven days after contact, scammers execute what researchers call the “charm offensive”—a calculated barrage of attention designed to make you feel seen, understood, and special.

They’re relentless. They’re consistent. They’re everywhere.

- Constant messaging: You’ll receive texts, emails, and app notifications multiple times daily—sometimes hourly.

- Rapid emotional bonding: Within days, they’ll share personal stories mirroring your grief, claiming they’re also widowed or understand loss intimately.

- Flattery and validation: Every message affirms your worth, your beauty, your resilience after loss.

- Accessibility and presence: They’re always available when you need them most, filling the loneliness that defines your days.

This isn’t coincidence. It’s deliberate orchestration designed to build online trust and emotional bonds before exploitation begins.

Within seven days, you’ll feel genuinely connected to a stranger who doesn’t exist. That’s precisely their intention.

Weeks Two-Three: Escalating Emotional Investment

By week two, the scammer shifts tactics entirely. “I love you” appears by day ten.

Messages flood in—hundreds daily. The fake persona claims you’re their soulmate, their reason to keep living. They’ve mirrored your grief perfectly, claiming they’re also widowed.

You’re not alone anymore.

By week three, the emotional dependency deepens dangerously. They probe gently: “Do you have savings? Life insurance?”

Vulnerability awareness works against you now—they’ve studied your loneliness, your need for connection. The first money request arrives wrapped in crisis: a medical emergency, a business setback, travel funds to finally meet you.

You hesitate. They sense it. More declarations of love flood your phone.

Research shows victims lose an average of $15,000 once that first payment clears.

Stop. Verify. Report immediately.

Red Flags That Signal a Romance Scam Before Money Disappears

Eight warning signs typically emerge within the first three weeks of contact—before a scammer asks for cash. We need to recognize red flag behaviors that signal deception early.

- Rapid “I love you” declarations within days, creating artificial emotional triggers designed to bypass your judgment.

- Reluctance to video chat or meet in person, despite claims of genuine interest and commitment.

- Vague occupational details with implausible explanations for isolation or communication delays.

- Probing questions about finances, inheritance, or retirement accounts masked as casual conversation.

Watch for trust signals that feel too perfect. They mirror your grief. They finish your sentences. They’re always available.

Real relationships develop slowly. Scammers accelerate everything. Document conversations immediately. Share profiles with family. Verify employment independently. Don’t ignore your instincts.

How to Verify Someone’s Identity and Protect Yourself Before It’s Too Late

How can you know if someone online is really who they claim to be? We can’t afford to assume.

Video chat them. Scammers avoid live video because deepfakes aren’t perfect.

Reverse-image search their photos on Google—fake profiles recycle stolen pictures repeatedly.

Ask specific questions about their claimed job or location. Real people answer naturally; scammers hesitate or deflect.

Check their social media history. Legitimate accounts show years of genuine activity, not weeks of romantic posts.

Never send money before meeting in person. Report suspicious profiles immediately to the platform.

Call your bank before transferring anything.

These steps take minutes but save thousands. Your online safety depends on verification now, not regret later.

People Also Ask

What Percentage of Romance Scam Victims Actually Recover Their Stolen Money?

Victim recovery rates remain dismally low, as scammers typically move stolen funds through overseas accounts or cryptocurrency channels, making retrieval difficult. Your best opportunity for restitution involves recognizing romance scam tactics early and reporting the fraud immediately to law enforcement and financial institutions. Prompt action preserves evidence and increases the likelihood that authorities can intercept funds before criminals fully conceal the money trail.

How Do Scammers Launder Money From Romance Fraud Victims Internationally?

Criminals move stolen funds through cryptocurrency channels, international wire transfers, and overseas bank accounts—methods that obscure trails and enable rapid money laundering across borders before you recognize the fraud. Understanding these common pathways helps you identify warning signs early and protect yourself from romance scams that target thousands of victims annually.

Are Dating Sites and Social Platforms Held Legally Liable for Scammer Accounts?

Dating sites and social platforms face limited legal liability for scammer accounts. Platform responsibility typically hinges on negligence claims, though Section 230 protections often shield them from direct accountability for user-generated deception by criminals.

Understanding this legal landscape helps you recognize that you cannot always rely on platforms to prevent fraudulent accounts. Scammers exploit gaps in platform enforcement, and you should take personal precautions when using dating sites and social networks. While platforms have some obligation to address obvious patterns of criminal activity, their legal protections are substantial.

You benefit from knowing that pursuing civil action against a platform for hosting scammer accounts faces significant legal barriers. Section 230 of the Communications Decency Act generally protects platforms from liability for content posted by users, even when that content involves deception. Courts have consistently upheld this protection.

Your best defense remains vigilance. Verify identities, never send money to unknown contacts, and report suspicious accounts to platform administrators. If you experience romance fraud or investment scams, you can report the perpetrators to the Federal Trade Commission and your local law enforcement, though recovering funds proves difficult.

You should advocate for stronger platform accountability measures in your community while understanding the current legal framework limits what victims can recover through civil litigation against the platforms themselves.

What Specific Cryptocurrencies Do Romance Scammers Prefer for Untraceable Payments?

Cryptocurrencies Commonly Used in Romance Scams

Criminals committing romance scams tend to favor Bitcoin and Ethereum because of their widespread adoption and relative liquidity. These cryptocurrencies can be moved through mixing services, which obfuscate transaction trails and make fund recovery more difficult.

Scammers occasionally use Monero as well, attracted by its built-in privacy features that provide enhanced anonymity compared to other cryptocurrencies.

Understanding these methods helps you recognize potential red flags when someone you’ve met online asks you to transfer funds via cryptocurrency. If you’re targeted with such requests, you should report the interaction to the platform where you met the person and to the FBI’s Internet Crime Complaint Center (IC3).

How Can Families Intervene When a Widow Refuses to Believe She’s Being Scammed?

How Can Families Intervene When a Widow Refuses to Believe She’s Being Scammed?

Families can combine gentle intervention strategies with emotional support by validating her feelings, involving trusted professionals like financial advisors or counselors, and demonstrating that you’re protecting her—not judging—while documenting red flags together.

Key approaches include:

- Validate her emotions first. Acknowledge that she may feel embarrassed, defensive, or emotionally invested in the relationship or opportunity. Scammers are skilled at building trust and isolation, so her resistance is understandable.

- Involve objective professionals. A financial advisor, elder law attorney, or counselor can present concerns without the emotional charge that family members sometimes carry. Criminals often count on family conflict to maintain their access.

- Document concrete red flags together. Review payment patterns, communication methods, and the scammer’s behavior objectively. You might ask questions like: “Why does this person always need money urgently?” or “Why won’t they meet in person?”

- Set boundaries gently but firmly. You cannot force someone to act, but you can limit financial access through joint accounts, require dual signatures on large transactions, or involve adult protective services if immediate danger exists.

- Remain patient. Victims of scams often need time to recognize the deception. Maintain the relationship while protecting assets where possible.

Three Rivers Star Foundation encourages you to seek guidance from elder services, law enforcement, or financial institutions to create a coordinated protection plan.

The Bottom Line

Don’t ignore red flags. Scammers wait nine months before asking for money. They study you. They learn your pain. We can stop them now. Verify identities through video calls. Never send cash to strangers. Ask trusted friends about suspicious profiles. Check military records online. Your loneliness isn’t weakness—it’s human. But fifty thousand dollars gone? That’s preventable. Stay alert. Stay safe.

Three Rivers Star Foundation works directly to combat romance scams targeting vulnerable grieving widows through targeted prevention education and community awareness programs. By teaching people to recognize manipulation tactics and verify identities before emotional investment deepens, the foundation helps survivors protect themselves from predatory scammers who exploit loss and isolation. Their resources equip families and friends with the knowledge to intervene early and support at-risk individuals.

Your donation funds prevention education. Donate.

References

- https://www.threeriversstarfoundation.org/blog/romance-scams-widows-widowers/

- https://emailsecurity.fortra.com/resources/guides/scarlet-widow-romance-scams

- https://www.malwarebytes.com/blog/news/2024/09/romance-scams-costlier-than-ever-10-percent-of-victims-lose-10000-or-more

- https://www.actionfraud.org.uk/romance-scams/elderly-romance-scams/

- https://lowcostdetectives.com/romance-scam-statistics-2025/

- https://www.cbsnews.com/philadelphia/news/pennsylvania-romance-scam-widow-life-savings/

- https://6abc.com/post/romance-scam-cary-nc-facebook-account-scammer/13815485/

- https://dos.ny.gov/news/consumer-alert-new-york-department-states-division-consumer-protection-warns-new-yorkers-about

- https://www.moaa.org/content/publications-and-media/news-articles/2025-news-articles/recommended-reads/true-love